Accounting Standard Updates

Got Risk Transfer?

Reinsurance agreements must contain the element of risk transfer where the reinsurer assumes significant insurance risk and may realize a significant loss from the transaction. However, there is an exception to these rules. In the following example, we demonstrate the “substantially all” exception to the essential elements of risk transfer.

Situation and Facts: Dolby Insurance Company (“Dolby”) sells nonstandard auto policies. Dolby and Freedom Reinsurer (“Freedom”) executed a quota share reinsurance treaty. Under the treaty, Dolby cedes 50% of its losses and premiums, excluding policy fees, to Freedom. The contract provides for a sliding commission under which the commission due to Dolby would be based on loss experience as follows:

| Actual Loss Ratio | Commission Rate |

| 75% or greater | 25% (minimum commission) |

| 65% – 74% | 30% – (Actual Loss Ratio – 65%) |

| 55% – 64% | 30% + (Actual Loss Ratio – 65%) |

| 54% or less | 40% (maximum commission) |

Dolby’s policy fees are approximately 6% of the written premium. As prescribed in the treaty, Dolby reports to Freedom ceded activity information within 30 days after the end of each month. Any balances due to Dolby are paid by Freedom within 10 days of receiving the information. For every successful policy acquisition, Dolby pays 19% in commission expense, 2.35% in premium taxes, and 6% in policy fees. Defense and Cost Containment (DCC) expenses are about 4% according to Dolby’s actuarial analysis. DCC to Freedom is capped at 2% in accordance with the treaty.

Prior to entering into a reinsurance agreement with Freedom, Dolby provided its actuary 10 years of company loss data. The actuary applied the 10/10 Rule, an analysis suggesting the reinsurance treaty possesses significant risk if there is at least a 10% probability of sustaining a 10% or greater present value loss.

Question: Does Dolby’s reinsurance contract with Freedom transfer risk in accordance with SSAP No. 62R, Property and Casualty Reinsurance?

Guidance: SSAP No. 62R, Property and Casualty Reinsurance

The essential element of a reinsurance agreement is the transfer of risk where the reinsurer indemnifies the ceding entity, not only in form but in fact, against loss or liability relating to insurance risk, which requires both of the following (SSAP 62R, paragraph 13):

- The reinsurer assumes significant insurance risk under the reinsurance agreement if both the amount and timing of the reinsurer’s payments depend on and directly vary with the amount and timing of claims settled by the ceding entity.

- It is reasonably possible the reinsurer may realize a significant loss from the transaction.

Application: In order for transfer of risk to exist, Dolby must be indemnified by Freedom against loss or liability related to insurance risk. Let’s apply both points above to the facts presented.

Point 1: The treaty meets this point of the guidance as policies covered are short tail and reimbursements from Freedom to Dolby are submitted within 10 days of reporting to Freedom. The facts presented do not indicate delay in the timing of payments, and amounts may vary depending on the turnout of the month.

Point 2: There must be a reasonable possibility of significant loss for Freedom for risk transfer to exist. Let’s assume after Dolby’s actuary applied the 10/10 Rule, results indicated a less than 10% chance for Freedom to sustain at least a 10% loss. (On the contrary, if the opposite were true, no further analysis would be necessary as risk transfer would exist). SSAP 62R, paragraph 16 is the exception to this rule. If Freedom is not exposed to a reasonable possibility of significant loss, Dolby can be considered indemnified against loss or liability related to insurance risk if substantially all of the insurance risk related to the reinsurance portion of the underlying insurance agreement has been assumed by Freedom (the “substantially all” exception). In other words, if Freedom’s exposure to loss is essentially the same as Dolby’s, then risk transfer exists.

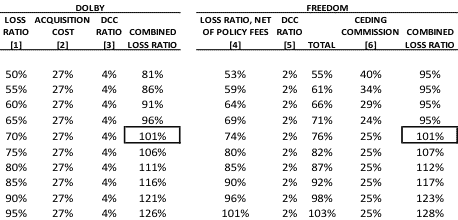

To better illustrate the substantially all exception, let’s assume each party has the same loss experience, incorporate the terms of the treaty to each loss experience to arrive at a combined loss ratio, and then evaluate whether Freedom’s exposure to loss is essentially the same as Dolby’s.

As illustrated below, at a 70% loss ratio, both Dolby and Freedom’s combined ratio is over 100%, an indication that both are experiencing losses. Freedom meets the substantially all exception rule as its exposure to loss is essentially the same as Dolby, and therefore, risk transfer exists.

[1] – increase at every 5% increment

[2] – 19% [acquisition cost] + 2.35% [premium tax] + 6% [policy fee] = 27%

[3] – as estimated by Dolby’s actuary

[4] – [1] / (100% – 6% [policy fees])

[5] – as provided in the reinsurance treaty

[6] – sliding scale commission schedule as provided in the reinsurance treaty

Conclusion: In order for the reinsurance agreement to contain the element of risk transfer, both components of insurance risk must exist. The agreement between Dolby and Freedom passed the first component, amount and timing of payments, but it didn’t meet the second component of insurance risk, which is possibility of a significant loss. However, because Dolby and Freedom had the same loss exposure under the reinsurance treaty, it met the substantially all exception and passed risk transfer conditions. In other words, when Dolby experienced a loss, Freedom experienced a loss as well, so the transaction qualifies as reinsurance. If the substantially all exception was not met, Dolby would need to account for the transaction under the deposit method.

This article follows the sequential order of SSAP 62R. However, in practice, the substantially all exception (paragraph 16) would be applied prior to evaluating possibility of a significant loss (paragraph 13).