Accounting Standard Updates

The Long-Awaited, Long-Duration Insurance Contract GAAP Rules Have Arrived

Article reading time: 3 minutes

Following ten years of off-and-on deliberations, the Financial Accounting Standards Board (FASB or the Board) has issued a final promulgation in the accounting for long-duration insurance contracts. The promulgation is effective for calendar-year public companies in 2021 and non-public entities in 2022.

JLKR Insight. Those in the insurance industry should be pleased the original 2007 concept design on insurance contracts was left on the drawing board. Those modifications would, for the most part, have eliminated the existing accounting model and established a measuring system that would have been considerably more complex and difficult in its application. The revised changes under ASU 2018-12, though very much a significant change, should be much more palatable to absorb, implement and understand.

In the works for over ten years. The FASB originally undertook its work in this area in 2007 with the International Accounting Standards Board (IASB). The initial FASB/IASB approach started with a comprehensive rewrite of rules governing the long-duration insurance accounting models and introduced a completely new and complex accounting prototype. The recoil from the U.S. insurance industry questioned the need for a complete revamp of insurance GAAP reporting when a workable and logical methodology had long been in place. (Keep in mind, the IASB was starting from scratch in this territory, and therefore had an open slate for its design of insurance accounting rules). Based upon U.S. industry reaction, the FASB reconsidered its original design and determined that the excessive complexity being introduced to an already workable accounting model was not necessary. This, in turn, produced the next generation of changes that focused on “targeted improvements,” rather than a complete conceptual revision of the insurance product accounting rules as they existed.

So, what products does this impact and what’s actually changing? The changes will apply to insurance entities issuing long-duration contracts such as life insurance, long-term care, disability income, and annuities. The new guidance does not apply to policyholders of long-duration contracts or non-insurance entities.

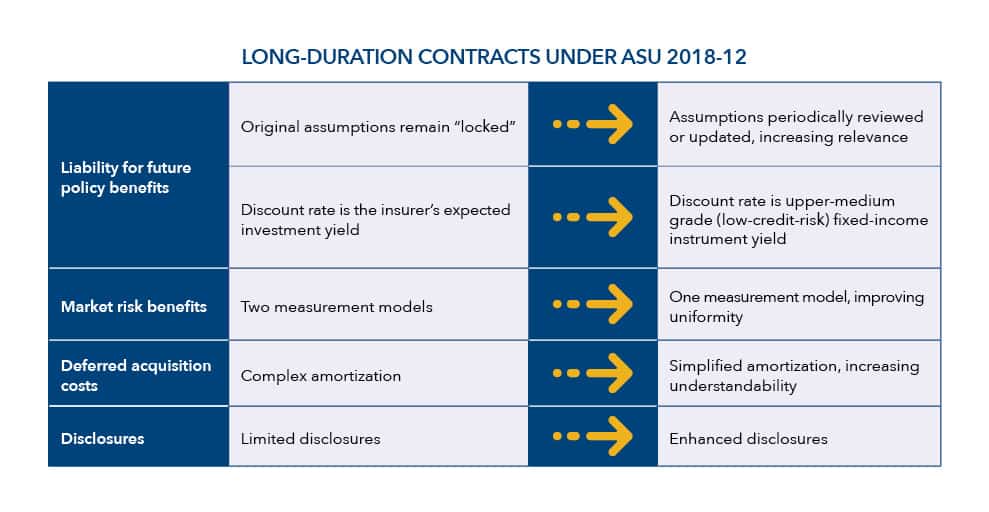

- There will be a revised measure of the insurance liability – the liability for future policy benefits for traditional and limited-liability insurance contracts will be required to be regularly assessed and adjusted for actual experience and assumptions. This should be accomplished at least annually;

- Discounting of the liability for future policy benefits – will now be based upon an upper-medium grade fixed-income instrument yield and updated at each reporting date. This eliminates the varying discounting approaches being utilized by companies using invested asset yield supporting the liability. Periodic changes in the discount rate will be reflected in Other Comprehensive Income (OCI);

- Amortization of deferred policy acquisition costs (DPAC) – DPAC will now be amortized on a constant level basis over the anticipated life of the contract. The expense pattern will no longer fluctuate in line with underwriting performance but will run off consistently. Interestingly, the DPAC will no longer be subject to impairment testing but will continue to be amortized as long as the contracts are effective;

- Market-based options and guarantees (think variable products) – a single measure of fair value will be utilized, with changes in the insurance entity’s credit risk recognized in OCI;

- Added disclosures – if you have not noticed over the past several years, the vast majority of Board issued promulgations lean heavily toward enhanced disclosure as a key ingredient. This issue is no different. New disclosures will now be required, including roll-forward of the liability, as well as significant inputs, assumptions, and judgments utilized in the measurement process.

The following table provides a graphical overview of the Long-Duration contracts under ASU 2018-12:

Table 1 – Source: FASB in Focus

Table 1 – Source: FASB in Focus

What’s the cost/benefit? The Board concluded through its cost-benefit considerations that there would be definite costs involved with insurance companies implementing the promulgation, including costs for auditors involved in assessing, testing and providing judgment on this new standard. However, the Board also felt the streamlined and consistent rules would alleviate differences in practice and provide benefits to investors and other users of the financial statements. The process will initially become an actuarial exercise, but accountants and auditors will need to remain integral in the communication and development process, and be ready to educate their employees about how to apply, record and explain the effects on their company’s financial statements.