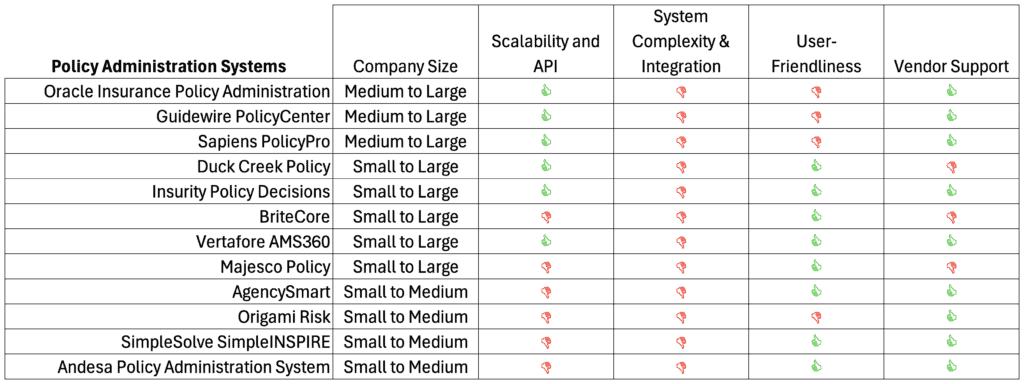

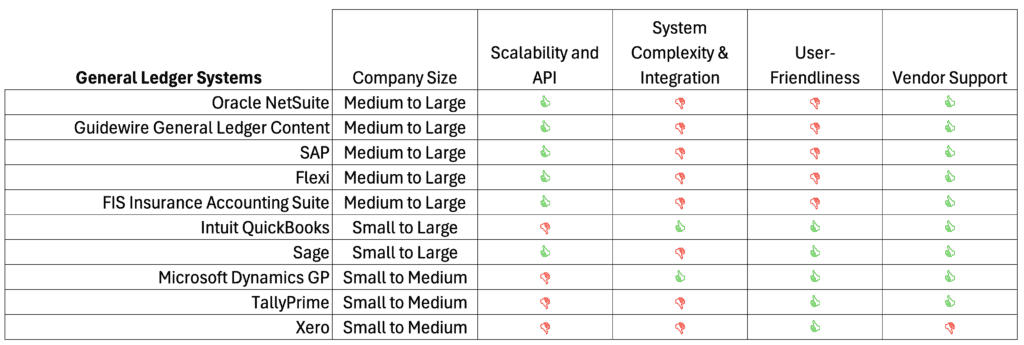

Selecting the Right PAS and GL Systems: Key Factors and Insights

Considered the backbone of insurance carriers, a policy administration system (PAS) helps manage insurance policies, including new and renewal business processing, quoting, billing, and automating complex tasks. Vital to this structural cornerstone is the integration with a general ledger (GL) system to transfer financial data generated by policy activities directly into the accounting system, eliminating manual data entry and ensuring accurate financial reporting to meet regulatory compliance requirements.

This article is intended to provide an abbreviated list of software available in the current marketplace, along with a snippet of factors to consider when constructing that insurance tech stack.

The Build

In determining the appropriate PAS, there are a number of options – develop a custom-built in-house system, purchase a third-party off-the-shelf PAS and custom develop internally or externally as needed, or utilize cloud-computing hosting arrangements that may also require custom development work directly with the vendor.

GL systems are typically purchased from third-party off-the-shelf systems with minimal customization.

Factors

Custom-built in-house systems are outside the scope of these factors due to significant customization and implementation time, higher costs, and unknown variability involved. The following factors should be considered when deciding on a PAS and GL system:

Scalability (including Application Programming Interface – API)

In particular, a PAS should be able to scale to meet the changing needs of the business. It should be able to handle increased data loads, new product lines, reporting for internal and external parties, or changes in the business structure without compromising efficiency or functionality.

System Complexity & Integration

PAS and GL systems should be able to seamlessly integrate with other systems used in the business, such as customer relationship management (CRM) systems, financial management systems, or billing platforms.

Ease of Use & User Interface (User-Friendliness)

PAS and GL systems should be easy to use with intuitive interfaces and clear navigation. It should help reduce the learning curve and lead to more effective task completion.

Vendor Support

Vendors should provide comprehensive training, regular updates, and prompt technical support

Factors and reviews were compiled from numerous software review sites, and inquiries were made with management of certain insurance carriers currently utilizing either system.

Summary

Final Thoughts

These systems’ scalability/API and user-friendliness will generally have an inverse relationship with company size. However, it is clear that the ease of integration for most systems is a challenge, and the complexities of each system will likely present roadblocks to any decision.

For more information, refer to our U.S. GAAP update on cloud computing expense guidance and our overview of statutory guidance on the admissibility of operating and nonoperating system software.