R&D Expensing Is Back: What the ‘One Big Beautiful Bill’ Means for Your Business

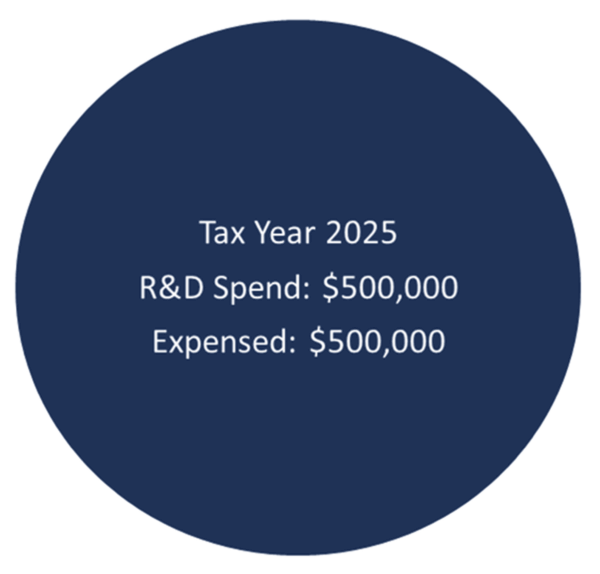

With the recently passed tax legislation nicknamed the ‘One Big Beautiful Bill,’ beginning in 2025 or tax years after December 31, 2024, Section 174’s current-year expensing of research and development (R&D) costs is reinstated permanently. This means instead of capitalizing and amortizing domestic R&D expenditures, you can choose to deduct them fully in the current year.

Below is a comparison of how current year expensing can help boost your cashflow immediately vs. amortizing over 5 years:

VS.

The option to amortize these costs equally over 60 months remains available. R&D tax planning strategies can help determine which options are best for your business goals. Foreign R&D expenses stay the same, however. Those costs will still be capitalized and amortized over 15 years.

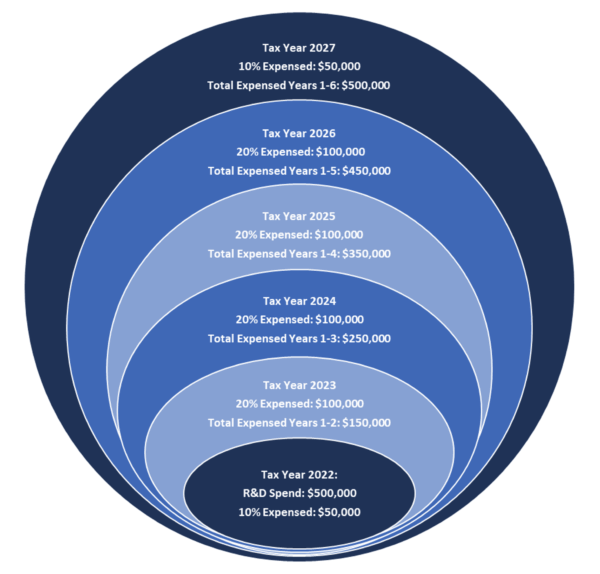

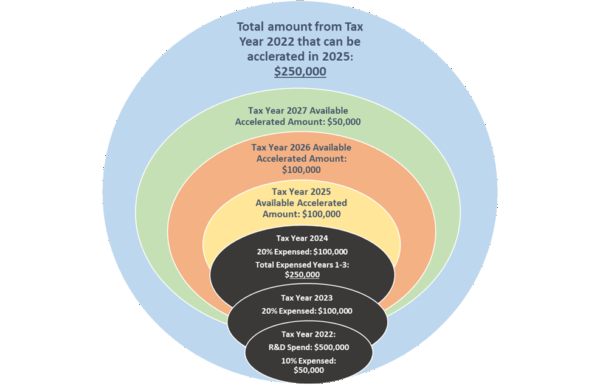

Option to Accelerate Amortized Expenses

Any taxpayer that amortized R&D expenses can elect to accelerate the remaining R&D amounts on the amortization schedules for tax years 2022 through 2024 and choose to deduct them all in 2025 or equally across 2025 and 2026. It is not a requirement, but an optional benefit available to taxpayers. At this time, it appears to be for all remaining amounts, rather than selecting to accelerate certain years.

An example for a taxpayer that claimed $500,000 in Sec. 174 R&D expenses for 2022:

*It is important to note that amortization of R&D costs is still required for tax year 2024.

Special Limited Opportunity for Certain Small Businesses

Qualified Small Businesses (“QSBs”) that pass the gross receipts test have a one-year timeframe from when the bill passed to amend and expense these costs back to tax year 2022. This means they have until July 4, 2026, to take advantage of the opportunity.

To determine eligibility, taxpayers must pass a gross receipts test defined in Section 448(c), which requires average annual gross receipts of $31 million or less for the tax years 2022 through 2024. Even if a taxpayer meets these requirements, it is optional, and they can still choose to deduct any remaining R&E amounts that were capitalized and amortized in 2025 or across 2025-2026, rather than amending. When opting to amend and recover these costs immediately, it is essential to ensure that you have proper documentation to support the R&D amounts claimed under Section 174.

Don’t Miss Out on Other Benefits Available

In addition to deducting R&D expenses, you may also be eligible to claim an R&D tax credit if you meet the Four-Part Test. The R&D tax credit is a powerful tax savings tool that puts money back into the hands of the taxpayer and boosts cash flow for many businesses. The Section 41 research tax credit is designed to reward taxpayers who create, experiment with, improve, and innovate, in whatever form and in whatever business or industry that process occurs.

We’re here to help

Are you ready to explore your options under the new R&D rules? JLK Rosenberger can help determine if you qualify for the small business election to recover these costs retroactively, as well as assess potential R&D tax planning strategies, including methods for applying accelerated deductions of prior amortized 174 expenses.

For additional information, call 972-931-6803 or click here to contact us. We look forward to speaking with you soon.