Boost Cash Flow for Your Manufacturing Business with R&D Tax Planning Strategies

In Brief

- Though often unrealized, many manufacturers qualify for research & development tax credits.

- Product design or improvements and technology integrations are activities that frequently qualify.

- Beginning in the 2025 tax year, eligible expenses can be fully expensed in the current year.

Despite the savings potential, R&D Tax Incentives are still largely misunderstood by most business owners and managers. The most common issue is an erroneous belief that current activities do not qualify or that only certain industries qualify. This misconception often prevents manufacturing companies and contractors from investigating the tax savings opportunity presented by this credit

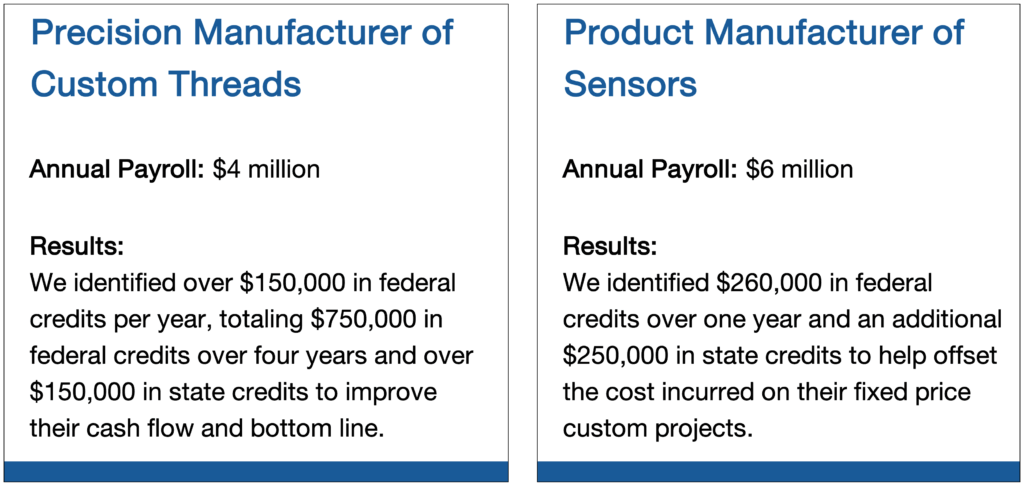

We have helped many in the manufacturing industry boost cash flow through R&D tax planning strategies, including custom product, formulation, food & beverage, rugged computing, plastics, and precision manufacturers, as well as machine shops, tool & die, various fabricators, and system integrators.

Many manufacturers are eligible to claim a Research and Development Tax Credit. You are likely conducting qualified activities if you are:

- Creating customized or new products, formulations, or component part designs.

- Performing drafting, such as CAD, CAM, CAE, etc.

- Engaged in custom detailing or programming.

- Crafting new or improved processes or techniques to manufacture, test, or assemble first articles.

- Testing new components, technologies, materials, or formulations.

- Integrating custom software or equipment to automate or improve an existing process.

The savings can be significant.

In addition to claiming a tax credit, the same expenses can be deducted in the current year beginning in tax year 2025. Instead of capitalizing and amortizing domestic R&D expenditures, you can choose to expense them fully in the current year. Further, any taxpayer that amortized R&D expenses can elect to accelerate the remaining amounts on the amortization schedules for tax years 2022 through 2024 and choose to deduct them all in 2025 or equally across 2025 and 2026. Small businesses that have less than $31 million in average gross receipts from 2022-2024 have until July 4, 2026, to amend and expense these costs immediately for these years.

We’re here to help

Calculating the Research & Development tax credit is a complex process that most often requires the assistance of a specialized tax consultant. If you are interested in determining whether your organization qualifies for these credits or need assistance with claiming the R&D credit, JLK Rosenberger can help.

For additional information, call 949-860-9208 or click here to contact us. We look forward to speaking with you soon.