Assurance Services for Foreign-Owned U.S. Businesses: Key Questions Answered

In Brief:

- Most foreign-owned U.S. subsidiaries are not required to have a statutory audit.

- When it comes to assurance services, there are several levels of engagement that provide different degrees of scrutiny and assurance. These include audits, reviews, and compilations.

- Financing needs, parent company requirements, and long-term growth plans will help determine which service level is best.

- Assurance services build trust, strengthen relationships, facilitate growth and reinforce internal governance.

Operating in the United States offers tremendous opportunities for foreign companies. However, navigating U.S. financial reporting and regulatory compliance can be a complex process. In this Q&A article, we delve into the nuances of statutory requirements, the various levels of assurance services, and how these services not only meet regulatory demands but also foster credibility among U.S. stakeholders. Whether you are entering the U.S. market or already operating a subsidiary, understanding which assurance services may best suit your business needs is essential.

Q1: Are there statutory financial reporting requirements for a foreign-owned U.S. subsidiary?

The requirement for statutory financial reporting in the United States depends on the nature and structure of your business. For most private companies — such as many foreign-owned U.S. subsidiaries — there is no mandatory statutory audit imposed by U.S. law. This is a key distinction from other global jurisdictions, where statutory audits may be required regardless of the company’s size or ownership.

That said, several factors may trigger the need for higher levels of assurance services:

- Financing needs or bank requirements: If your business is seeking financing, lenders and investors may require audited or reviewed financial statements as a condition for providing funds. Even though U.S. law does not impose an audit for a private company, external financing sources may require an independent opinion on your financials as a condition of receiving financing.

- Parent company consolidation requirements: Many foreign parent companies require that their U.S. subsidiaries provide consolidated financial statements that adhere to global reporting standards. Depending on the parent’s internal policies and the financial aggregation process, your subsidiary might be expected to submit either audited or reviewed financial statements.

- Preparation for mergers, acquisitions, or public listing: When preparing for a merger, acquisition, or public offering (IPO), audited financial statements are often a prerequisite. They provide the level of assurance needed for investors, buyers, or underwriters to conduct thorough financial due diligence, assess risks, and make informed decisions. If your long-term strategy involves going public, you will need to comply with the reporting requirements enforced by the Securities and Exchange Commission (SEC) and the Public Company Accounting Oversight Board (PCAOB). This entails a comprehensive audit conducted in accordance with PCAOB standards, encompassing financial statements and internal controls.

In summary, if you are a privately held business without external financing, foreign parent company requirements, or public listing ambitions, you generally are not compelled by statute to obtain an audit. However, it is wise to consult with industry specialists — such as accountants or legal advisors — who understand the intersection of U.S. and foreign regulatory environments.

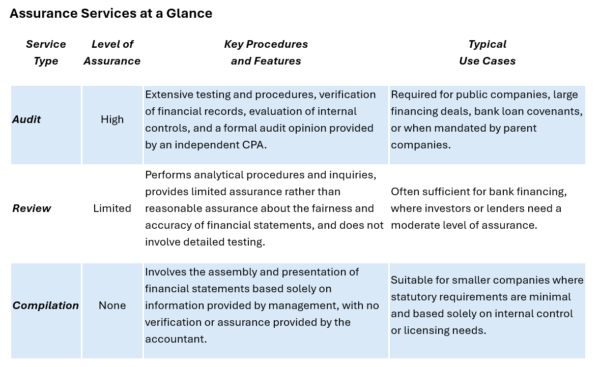

Q2: What are the differences between audit, review, and compilation services?

When it comes to assurance services, there are several levels of engagement that provide different degrees of scrutiny and assurance. Understanding these differences is crucial for aligning your financial reporting effectively with your business objectives and stakeholder expectations. Below is a detailed comparison:

- Audit: An audit represents the highest level of assurance. It is designed to provide stakeholders with confidence in the accuracy and completeness of your financial statements. Audits include a comprehensive evaluation that covers financial reporting, internal control systems, and compliance with relevant accounting standards. For foreign companies preparing for public offerings or large-scale financing transactions, an audit is indispensable. Moreover, if you have a parent company that consolidates your U.S. operations into its global reports, an audit might be required by your corporate governance structure.

- Review: A review engagement is less rigorous than an audit, offering a moderate level of assurance. The process primarily involves analytical reviews and inquiries into the financial statements, without the exhaustive testing present in an audit. This level of assurance is often acceptable when external parties, such as banks or investors, require evidence of sound financial practices, but a full audit isn’t cost-effective or necessary given the business’s scale.

- Compilation: A compilation engagement solely involves assembling financial statements based on information provided by management. There are no attestations or third-party verification of the numbers presented. For many small or emerging companies, especially those that are privately held, a compilation can suffice for internal use or to fulfill regulatory filing requirements if no external assurance is required.

Determining the appropriate level of service depends on several factors, including regulatory requirements, financing needs, and the overall size and complexity of the business.

Q3: How do I determine which level of assurance service is best for my business?

Choosing the right assurance service depends on a careful evaluation of your company’s unique circumstances, strategic objectives, and financial needs. Here are several key considerations:

- Regulatory and contractual demands:

-

- If your business is part of a group that requires consolidated financial statements or if regulatory bodies require audited financial statements (such as in the lead-up to a public offering), then an audit becomes necessary.

- When approaching banks for financing, your borrowing instruments or loan covenants may stipulate a minimum level of assurance. Typically, banks prefer to see either a review or an audit, where the decision often hinges on the size of the financing arrangement.

2. Size and complexity of the company:

-

- For a U.S. subsidiary with simple, low-risk operations, such as a startup with minimal transactions, a compilation may be adequate.

- In contrast, larger entities with more complex operations or significant revenue streams might require the enhanced scrutiny provided by a review or audit, especially if these companies have public float sizes that exceed certain thresholds (for example, public float over $75 million may trigger internal control audit mandates).

3. Long-term strategic goals:

-

- Companies planning for growth, regulatory expansion, or eventual public listing might opt for higher-level assurance services preemptively to build robust financial reporting systems.

- When mergers and acquisitions are on the horizon, shareholders and prospective partners often require that financial statements have been subject to independent verification. A higher level of assurance through an audit can instill substantial confidence in the quality and reliability of your financial records.

4. Cost considerations:

- While audits provide the highest level of assurance, they are also the most costly. For small, privately held companies, the additional costs may not be justified unless external pressures, such as financing or investor demands, require them.

- In this context, a review or even a compilation might strike the right balance between cost efficiency and the need for financial transparency.

In practical terms, the process begins with a discussion with your financial advisor or accountant. They can help assess whether your business requires a certain level of service based on your current operations, anticipated growth, and financing plans. By doing so, you not only meet the minimum requirements but also build a framework that supports the long-term credibility and transparency of your financial practices.

Q4: Even without a statutory obligation, why should a foreign business invest in assurance services?

Assurance services are not solely about compliance; they play a strategic role in enhancing your business’s reputation and reliability. Here’s why pursuing assurance services can be invaluable even when not mandated by law:

- Building trust and credibility: For foreign companies entering the U.S. market, establishing credibility is paramount. Independent assurance, whether through an audit or review, signals to investors, banks, and partners that your financial reports are accurate, reliable, and credible. This transparency helps foster trust even in the absence of legal mandates.

- Strengthening stakeholder relationships: Transparent financial reporting can ease concerns among key stakeholders. For example, banks may view your business as a better credit risk if your financial statements have undergone rigorous assurance procedures, making it easier to secure financing on favorable terms. Similarly, investors and strategic partners may place more confidence in your business when there is third-party verification of your financial performance.

- Facilitating strategic growth: Assurance services serve a dual purpose. Beyond regulatory compliance, they create a robust internal control system that helps identify and mitigate risks. This not only underpins your business operations but also positions your company for strategic growth, particularly when considering mergers and acquisitions. In M&A scenarios, a due diligence process supported by independently assured financials becomes critical. It helps identify hidden liabilities, ensure the soundness of financial practices, and ultimately secure a fair valuation for your business.

- Reinforcing internal governance: Engaging with assurance services often leads to better internal monitoring processes. For instance, even if your U.S. subsidiary is a small-scale operation, periodic reviews and compilations can highlight inefficiencies and promote improvements in internal controls. This proactive approach to governance helps prepare your company for future challenges, ensuring that as you scale, your financial reporting remains trustworthy.

Conclusion

Choosing the right level of assurance service, whether an audit, a review, or a compilation engagement, is not a one‑size‑fits‑all decision. For foreign-owned U.S. companies, this choice depends largely on factors such as the company’s structure (private vs. public), financing needs, parental consolidation demands, and long-term strategic objectives. Even if not legally required, pursuing higher-level assurance services can help build trust, facilitate access to financing, support mergers and acquisitions (M&A) activities, and enhance overall internal governance.

We’re here to help

Ultimately, aligning your financial reporting with the appropriate level of assurance is an investment in credibility and trust. By understanding statutory requirements, comparing service types, and assessing your unique needs, you can navigate the landscape of financial reporting with confidence, a vital step in establishing and growing your presence in the U.S. market.

If you have questions about assurance services for your foreign-based business, we can help. Contact your JLK Rosenberger team member, or click here to contact us. We look forward to speaking with you soon.