The Texas Investment Basket Clause, A Sometimes-Overlooked Gem

Each state has laws and regulations governing the investments of insurance companies domiciled in their state. The Texas Insurance Code (“TIC”) provides regulations and investment limits for both property & casualty insurers in Chapter 424, and for life, health, and accident insurers in Chapter 425. The article below discusses the various limits under Chapter 425 §101-232 applicable for life and health insurance companies domiciled in Texas. The limits presented in the section below are only applicable to life, health, and accident insurers.

Investment Limits

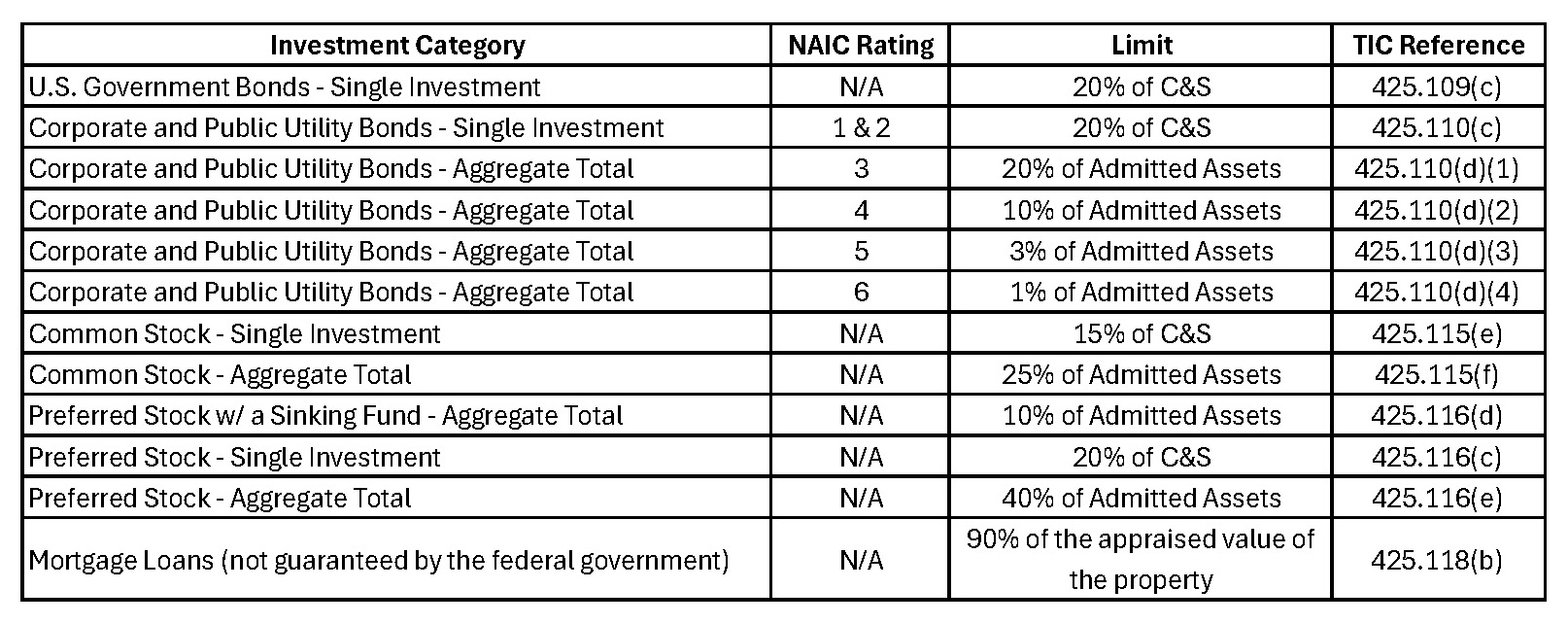

TIC Chapter 425 contains various investment limits based on the type of investment. All of the limits within Chapter 425 apply to the cost basis of the investment at the time of acquisition. Some of the key investment limits for bonds and common stock from that chapter are detailed below:

U.S. Government Bonds – limited to 20% of capital and surplus for a single investment (TIC 425.109).

Corporate and Public Utility Bonds – bonds with an NAIC designation of 1 or 2 are limited to 20% of capital and surplus for a single investment. Bonds with an NAIC designation of 3 or lower are limited to 20% of capital and surplus in the aggregate. Bonds with an NAIC designation of 4 or lower have an aggregate limit of 10% of admitted assets. Bonds with an NAIC designation of 5 or lower have an aggregate limit of 3% of admitted assets. Bonds with an NAIC designation of 6 or lower have an aggregate limit of 1% of admitted assets (TIC 425.110).

Common Stock – all common stock investment entities must have a net worth of at least $1 million. Further, common stock investments are limited to 15% of capital and surplus for a single investment and 25% of admitted assets in aggregate (TIC 425.115).

Preferred Stock – insurance companies may only invest in preferred stock rated by the Securities Valuation Office of the NAIC. Investments in preferred stock rated 3 or below are subject to the same limitations provided above for Corporate and Public Utility Bonds. Single investments are limited to 20% of capital and surplus, with an aggregate limit of 40% of admitted assets (TIC 425.116).

The common stock investment limits above do not apply to investments in subsidiaries or affiliates within a holding company system (TIC 425.103(c)). The limits only apply to investments in unaffiliated entities. Chapter 425 also contains further limits for real estate and other investment categories. See the table below for the investment limits under Chapter 425 and specific Texas Insurance Code references:

Basket Clause

TIC 425.152 contains a buffer zone known as the “Basket Clause,” which captures investments not included within Chapter 425, and not otherwise prohibited, along with any investments that exceed the limits provided within Chapter 425.

The Basket Clause gives life and health insurers flexibility under Chapter 425 to invest past the limits stated within that Chapter and seek alternative investments, as long as those investments are not specifically prohibited by another section of Chapter 425. The Basket Clause is limited to 10% of capital and surplus for a single investment included in that clause and the lesser of 5% of admitted assets or the excess capital and surplus over the Company’s statutory minimum capital and surplus in aggregate.

We included an example below to help illustrate how the investment limits and basket clause work together under the Texas Insurance Code.

Illustration

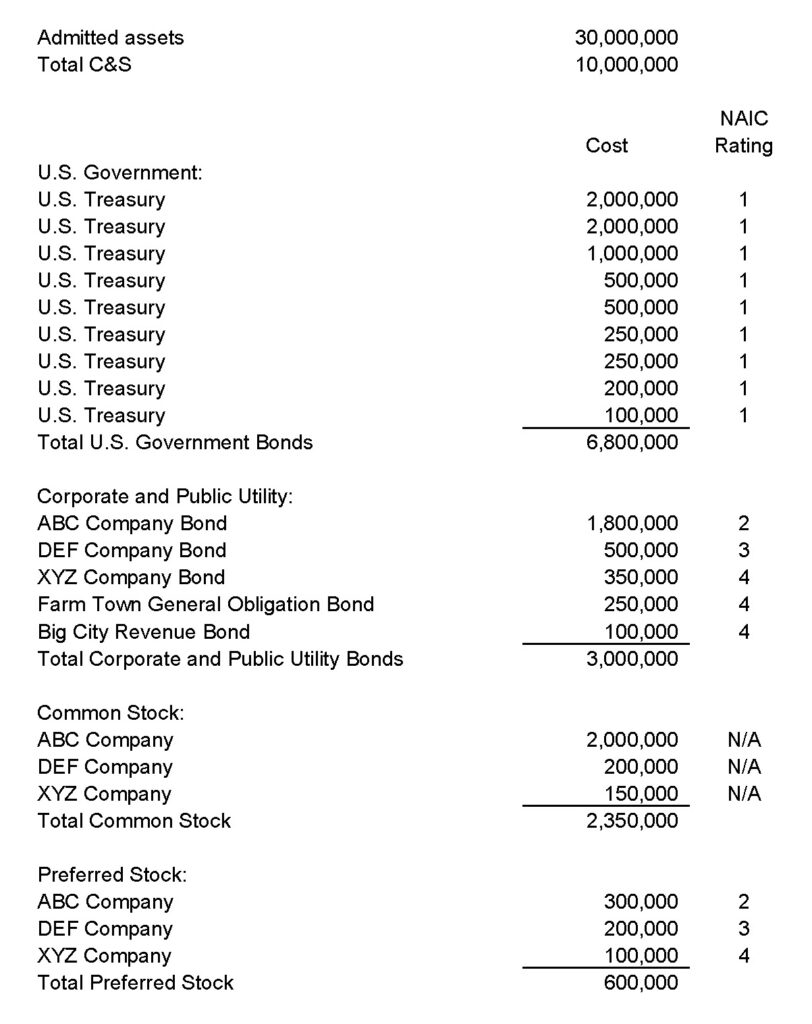

Assume a life insurance company domiciled in Texas has the following investments along with total admitted assets of $30 million and total capital and surplus of $10 million:

The illustration below shows the application of the TIC limits to this company’s investment portfolio along with the amount that flows into the basket clause:

In the illustration above, $700,000 would be added to the basket clause. Assuming the basket clause had a beginning balance of $0, all of the company’s investments would be admitted for regulatory filings since the $700,000 excess is below the 10% capital and surplus limit of $1,000,000.

Summary

It is important for all insurance companies to monitor the investment limits provided by their state of domicile, and to incorporate those limits within their own written investment policy to maintain compliance with applicable state law. Entities should carefully track investments within the Basket Clause to avoid exceeding the statutory limits. The beginning and ending balances of each investment category within the basket clause should be closely monitored for each reporting period to ensure compliance with Chapter 425 of the Texas Insurance Code.

TIC Chapter 425 contains more limits than presented above covering other investments such as mortgage loans, exchange-traded funds (ETFs), etc. – please refer to TIC Chapter 425.

We’re here to help

If you have any questions about compliance with the investment limits within the Texas Insurance Code or the TIC Basket Clause, we can help. Contact your JLK Rosenberger team member, or click here to contact us. We look forward to speaking with you soon.