Accounting for Reinstatement Premiums

Insurance companies are answering questions from their policyholders about reinstating policy coverages daily, but what happens if the insurance company itself needs to restore its coverage?

A variable feature of excess of loss reinsurance contracts is a reinstatement clause. Suppose the reinsurer’s limit under the contract is exhausted before the expiration of the agreement. In that case, the insurer can restore the coverage originally provided by the contract by paying additional premium (reinstatement premium).

This article will show a calculation of reinstatement premium estimates for financial reporting purposes. It is important to note that reinstatement clauses are not one-size-fits-all. They are drafted in different forms or languages, and careful reading of the contract is required to ensure proper accounting treatment.

Accounting

As per SSAP 62, paragraph 30, if the amounts paid for reinsurance are subject to adjustment and can be reasonably estimated, such estimated amount shall be the basis for amortization.

To estimate the reinstatement premium amount, ultimate losses must be taken into consideration. The estimate should be periodically reevaluated until all claims falling under the particular reinsurance treaty are closed (and their reserves are zeroed out).

When the reinsurer’s maximum limits under the agreement are exhausted, the related original ceded premium is then to be fully earned. Any subsequent reinstatement premiums are earned over the remaining term of the reinsurance agreement.

Example

On July 1, 20X1, Insurance Company Inc. entered into a per-event excess of loss reinsurance contract with Reinsurer Re to reinsure the excess liability that may accrue under its claims-made policies issued or renewed during the term of the contract.

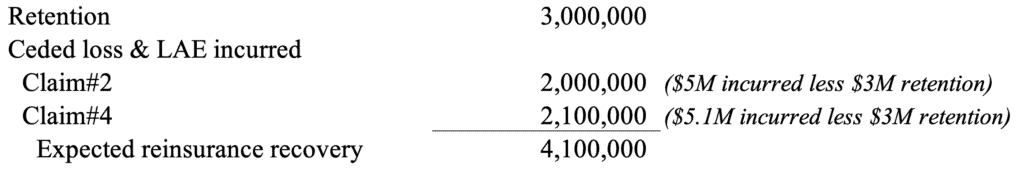

The insurer’s retention under the contract is $3 million per event, with a maximum reinsured covered loss of $15 million.

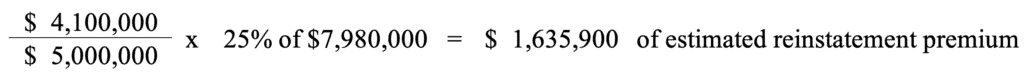

The contract further states, “With respect to the first $5 million of reinsured limit exhausted as respects any number of loss events, Insurance Company Inc. agrees to pay, simultaneously with the Reinsurer Re’s loss payment, an additional premium (reinstatement).” This is accomplished by multiplying the percentage of the first $5 million of exhausted reinsured losses by 25% of the net reinsurance premium paid or payable under this contract.

The deposit premium for this treaty is $8 million, payable in quarterly installments of $2 million on September 30, 20X1, December 31, 20X1, March 31, 20X2, and June 30, 20X2. Within 90 days following the contract expiration, Insurance Company Inc. is to calculate the adjusted premium due to/from Reinsurer Re. at a rate of 19% of subject net written premium.

At the end of the calendar year 20X1, the subject net written premium (NWP) is $42 million. Insurance Company Inc. has a steady policyholder base and follows the renewal date of July 1 for the majority of its policies, with immaterial adjustments throughout the year.

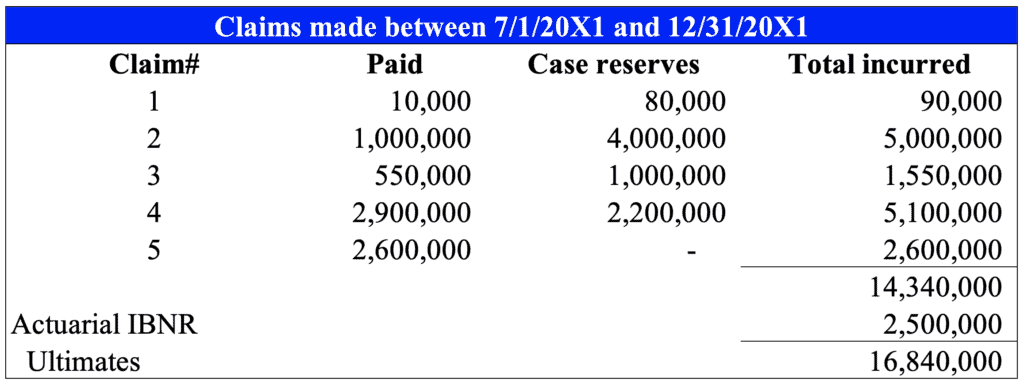

The following is the summary of subject direct claims activity:

What would be a reasonable estimate of the reinstatement premium for financial reporting purposes on December 31, 20X1 reporting date?

The incurred loss & LAE pertaining to claim #1 are clearly immaterial, and it does not appear probable that the insurer could reach the reinsurance treaty retention threshold of $3 million.

Even though the paid loss and LAE of claims #2 and #4 have not yet reached the reinsurer’s limits, their case reserves indicate a probability of reaching the limits in the future. These claims should be included in the reinstatement premium estimate calculation.

At this time, it does not appear probable that claim #3 triggers reinsurance (has not yet reached the insurer’s retention) unless subsequent evidence obtained shortly after the financial reporting date indicates otherwise.

While the total loss and LAE incurred of $2.6 million on claim#5 are close to the insurer’s retention of $3 million, the claim is closed with zero reserves; hence, it is not probable that it will trigger the treaty limits unless reopened in the future.

Reinstatement premium estimate calculation on December 31, 20X1, would then be as follows:

This calculation is to be revisited at each reporting date until all claims subject to the treaty are closed.

To book, or not to book, that is the question

Once there is an estimate of reinstatement premium, several more questions must be addressed before determining proper accounting.

- Is the reinstatement clause in the agreement mandatory or nonmandatory?

- If nonmandatory, does the company intend to reinstate the coverage?

- Is the transaction material?

- When determining materiality, the impact of both the reinstatement premium accrual and the earn-out of previously recorded ceded premiums should be taken into consideration. Because the coverage provided under the reinsurance contract before reinstating was exhausted, the respective ceded premium previously recorded must be fully earned to honor the accounting’s matching principle.

- If the reinstatement premium estimate is mostly driven by the reserves (i.e., expected future payouts) like our example above, how long does it usually take for the company to settle the claims? What is the experienced volatility between expected and actual payouts?

- The reserves on claims pertaining to short-tail occurrence-based policies are usually a reliable indicator of any need for reinstatement premium.

- However, the verdicts pertaining to claims on some long-tail claims-made policies might be subject to greater volatility over time. A case could be made to wait with the accrual until the settlement becomes probable and known.

While accounting may not always be perfectly accurate, it must always remain unbiased. When asked by auditors or regulators, insurance companies should be able to provide their calculation of reinstatement premiums as well as underlying documentation to support the amounts recorded in their financial statements.

Conclusion

Reinstatement premiums are one of the key risk-management tools. A number of factors need to be considered, such as severity and frequency of claims and underwriting guidelines.

JLK Rosenberger is here to help with the intricacies of reinstatement premiums and other variable features of reinsurance contracts.

Did you know?

There is a market (and price) for everything. Some companies are willing to buy your misfortune. How is that? Since reinstating the reinsurance coverage can become costly, reinsurers have developed a product called Reinstatement Premium Protection Cover to indemnify insurance companies from the potential of paying reinstatement premiums when excess losses occur.