Ceding Commissions: What Insurers Need to Know

Ceding commissions are critical for helping insurers manage surplus strain caused by the upfront expensing of acquisition costs under SAP. However, not all ceding commission arrangements are simple. Errors, particularly with deferred ceding commissions, can lead to audit adjustments and reporting challenges.

This insight explains the essentials of surplus relief, profit and sliding scale commissions, and how to properly account for deferred ceding commissions to avoid surprises in your annual statement filing.

One notable difference between the GAAP and SAP accounting frameworks for insurance companies lies in the treatment of policy acquisition costs, including agent and broker commissions, as well as policy issuance costs. Under GAAP, these costs are capitalized and amortized over the life of the policy (i.e. matching revenues and expenses). In contrast, SAP requires these expenses to be recognized immediately when incurred (as outlined in SSAP No. 71 – Policy Acquisition Costs and Commissions, paragraph 2).

Expensing all acquisition costs upfront can place considerable strain on an insurance company’s surplus. To alleviate this temporary negative impact, insurers often seek relief through ceding commissions.

Surplus Relief

Ceding commissions arise in the context of reinsurance, particularly within proportional reinsurance treaties such as quota share. They represent commissions and certain other acquisition-related expenses paid by the reinsurer to the insurer on the ceded business. These commissions are recognized immediately as income, offering much-needed relief to the insurer’s surplus.

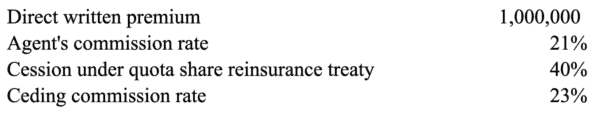

In this basic example, a flat ceding commission with no adjustable features is calculated by multiplying the premium ceded under the treaty by the agreed ceding commission rate.

The diagram below illustrates the parties involved in an insurance transaction and the movement of the ceding commission:

Adjustable Features

According to SSAP No. 62 – Property and Casualty Reinsurance, there are two primary types of ceding commission adjustments: profit commissions and sliding scale commissions.

- Profit commission – Under a profit commission arrangement, the reinsurer reimburses the ceding company with a portion of the profits generated from the ceded business. The reinsurer’s profit is calculated by deducting actual losses, ceding commissions, and expenses from the treaty premiums. A predetermined percentage is then applied to the calculated profit to arrive at the amount payable to or due from the ceding company. The time period for a profit commission calculation formula can span several years of contract experience.

- Sliding scale commission – A sliding scale commission also adjusts based on actual loss experience. The higher the loss ratio, the lower the final commission rate. Initially, a provisional commission is paid during the treaty period. After the treaty concludes and claims are closed, a final adjustment is made to reflect the actual loss experience.

Deferred Ceding Commission

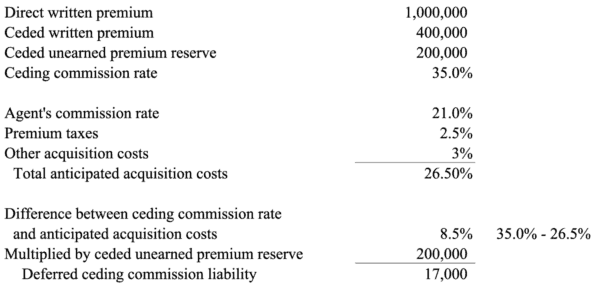

The ceding commission rate specified in a reinsurance agreement can exceed the expected acquisition costs associated with the ceded business. When this occurs, the ceding entity must refrain from recognizing the full amount of ceding commission as income. Instead, it should establish a liability for the excess of the ceding commission over the anticipated acquisition costs. This deferred income (liability) must then be amortized on a pro rata basis over the duration of the reinsurance contract, aligned with the proportion of reinsurance coverage provided during the contract period.

Insurers sometimes overlook the comparison between direct and ceded acquisition costs, which can lead to audit adjustments if not properly considered during the preparation of the financial statements.

A straightforward example illustrates the calculation of a deferred ceding commission liability:

Conclusion

While the mechanics of ceding commissions can be complex, getting them right is essential for regulatory compliance and financial stability. JLK Rosenberger’s insurance team can help you navigate these calculations and optimize your reinsurance agreements.