What Is the Combined Ratio in Insurance? How It Measures Profitability and Performance

In Brief

- The combined ratio is a key performance metric in the insurance industry, especially for property and casualty (P&C) insurers.

- It measures underwriting profitability by adding two components:

- Loss and loss adjustment expense (LAE) ratio

- Underwriting expense ratio

- A combined ratio below 100% indicates an underwriting profit, while a ratio above 100% signals an underwriting loss.

- Regulators use the combined ratio to evaluate insurer financial health and identify early warning signs of potential issues.

- Insurers rely on it to guide pricing strategies, reserve adequacy, and overall performance management.

- At JLK Rosenberger, LLP, we help insurance companies analyze and interpret these ratios, uncover the story behind the numbers, and apply insights to make stronger, data-driven business decisions.

Combined ratio

In the highly regulated insurance industry, state departments of insurance rely on a variety of financial ratios to assess the financial health of insurers. Among these, the combined ratio stands out as a key performance metric. When these ratios deviate from industry norms, they act as red flags, prompting regulators to dig deeper into an insurer’s operations. For insurance companies themselves, these ratios serve as crucial early indicators of potential issues involving capacity, liquidity, and profitability.

The combined ratio is a widely-used measure of underwriting performance in the property and casualty insurance industry. It’s the sum of two key components:

- Loss and loss adjustment expense (LAE) ratio

- Underwriting expense ratio

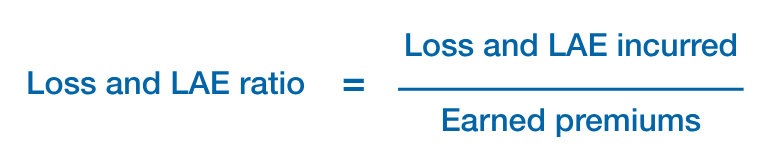

Loss and LAE ratio

This ratio reflects how much of each premium dollar is used to pay claims and related adjustment expenses. For example, if an insurer collected $1,000 in premium and paid a total of $750 to close the claims during the policy term with no remaining reserves (hence the loss and LAE incurred is $750), the loss and LAE ratio would be 75%.

However, insurers often have thousands of policies in force, each at different stages of the policy lifecycle. To calculate this ratio accurately, insurers compare incurred losses and LAE to earned premiums for a given reporting period. It’s important to use earned premiums rather than written premiums to ensure accurate matching between income and associated claims (i.e. comparing claims that have already occurred against the premiums already earned). Fundamentally, insurers can only reserve for known or incurred-but-not-reported (IBNR) claims—not for hypothetical future claims. This reinforces the importance of aligning the timing of claims and earned premiums when evaluating financial results.

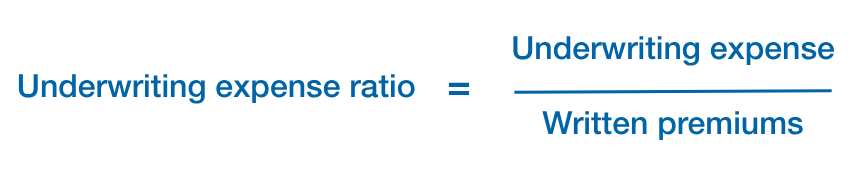

Underwriting expense ratio

In addition to claim costs, insurers face other expenses associated with issuing and maintaining policies. These include:

- Acquisition costs like agent commissions and premium taxes

- Operational costs specifically associated with underwriting such as salaries, rent, licensing fees, and administrative expenses

Unlike the loss and LAE ratio, the underwriting expense ratio typically uses written premiums as the denominator. This is because, in statutory accounting, acquisition costs are expensed at the start of the policy, not spread over its duration. As such, the underwriting expenses reported for a given period reflect costs associated with all policies written, including the unearned portion.

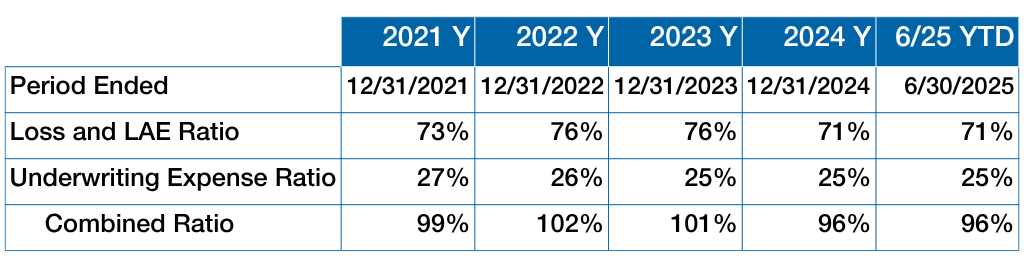

Industry Snapshot: U.S. P&C Combined Ratios

Here’s a look at combined ratio trends in the U.S. property and casualty insurance industry over the past four years:

Source: S&P Global Market Intelligence

For instance, in 2024, insurers spent 96 cents on claims and underwriting expenses for every premium dollar earned. In 2023, that figure was $1.01, indicating an underwriting loss. However, this does not necessarily imply an overall financial loss—investment income is available to provide offset to underwriting deficits, contributing to net profitability.

Conclusion

The combined ratio not only evaluates past underwriting performance, but it also helps insurers make informed decisions about future pricing strategies and reserve adequacy.

We’re here to help

At JLK Rosenberger, LLP, we go beyond simply calculating industry ratios. We help insurance companies interpret these metrics, understand the story behind the numbers, and apply the insights to drive more sustainable business decisions. If you have any questions about ratios, we can help. Contact your JLK Rosenberger team member, or click here to contact us. We look forward to speaking with you soon.