What Changes Are Coming to the California R&D Tax Credit Calculation in 2025?

In Brief

- Beginning in 2025 (tax years starting after 12/31/2024), California is replacing the Alternative Incremental Credit (AIC) with a new version of the Alternative Simplified Credit (ASC).

- The new ASC calculation uses a flat credit rate of 1.3% or 3%, depending on whether the taxpayer has qualified research expenses in the prior three years.

- California’s new ASC method follows the federal ASC structure but uses significantly lower rates than the federal credit (6% and 14%).

- The new method removes the need for prior-year gross receipts and instead compares current-year research costs to the average of the prior three years.

- Taxpayers must elect the ASC method on their originally filed return; it is not automatically applied if AIC was used in prior years.

- Once ASC is elected, changing methods generally requires FTB consent, so evaluating all available methods before filing is important.

Beginning in 2025 (tax years beginning after 12/31/2024), as part of the state’s conformance with SB 711, California will replace the current Alternative Incremental Credit (AIC) method with a version of the Alternative Simplified Credit (ASC) method, similar to the one used at the federal level with some key differences – most notably the credit rates. JLK Rosenberger breaks down these changes and potential tax implications below.

What Has Changed?

Under the prior AIC method, California businesses calculated their R&D credit using a three-tiered percentage structure based on the prior four-year gross receipts. Beginning in 2025, the new ASC method replaces this with a flat rate of 1.3% or 3%, depending on whether the taxpayer has qualified research expenses (“QREs”) in the prior three years. The federal ASC credit rate is much higher (6% and 14%), while California’s new ASC rates are 1.3% and 3%. Aside from the rate differences, the calculation now follows the federal ASC methodology, eliminating the need for prior year gross receipts. Instead, the new method compares the current year expenditures with the average of the prior three year research costs.

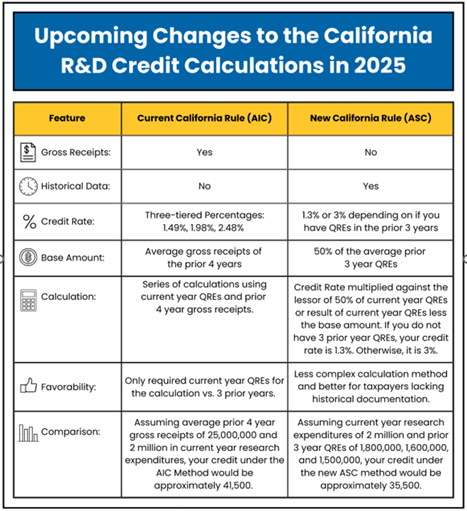

The table below highlights some of the key differences between the existing AIC calculation and the new ASC method.

How do I determine which methodology is best for me?

You should consult with a R&D credit professional to calculate the credit for you using each method, the Regular method, which has not changed, or the new ASC calculations available. It is crucial to do this in advance of filing as once you invoke the ASC; you do need the California’s Franchise Tax Board’s (FTB’s) consent to change it.

If I filed previous returns under the AIC method, will that election automatically result into the ASC method?

No, you must elect ASC on your originally filed return, but for the first year, do not need to file for FTB consent to elect it.

If I elect ASC but want to use another method, how to I change it?

You can make a request prior to filing your original tax return by filing a federal form 3115 or federal form 1128, and submit a cover letter and form to the FTB via fax at (916) 855-5557 or by mail to the following address:

Franchise Tax Board

ATTN: Change in Accounting Periods & Methods Coordinator

PO Box 1998

Rancho Cordova, CA 95812

We’re Here to Help

The California state R&D tax credit offers significant savings for those who qualify. Since the details are complicated with the change in calculation methodologies, it is important to consult with a qualified tax professional who can guide you through the process. If you have questions about the information outlined above or need assistance with the California R&D credit, JLK Rosenberger can help. For additional information, call 949-860-9902 or click here to contact us. We look forward to speaking with you soon.