Drive Tax Savings with a New Retirement Plan

- Many California businesses must participate in CalSavers if they do not offer a retirement plan, but this program provides no tax benefits.

- Establishing an IRS qualified retirement plan provides federal tax credits that offset startup and contribution costs.

- Three key credits include the Retirement Plans Start Up Costs Credit, Employer Contribution Tax Credit, and Automatic Enrollment Credit.

- These incentives can generate tens of thousands in tax savings, often making the cost of starting a qualified plan essentially free.

Many small businesses not offering an employer sponsored retirement plans are required to enroll and participate in the state of California’s CalSavers program. It is designed to ensure that businesses of all sizes provide employees with a retirement savings opportunity through an automatic payroll deduction. The deadline for registration for most businesses has passed, with only the smallest of companies now required to register by December 31, 2025. While participating employers are not required to manage investment options or process distributions, there are several tasks that must be completed. This includes managing employee enrollment, opt-outs, staying current with eligibility rules, and then submitting employee contributions. In other words, these time-consuming administrative tasks fall to company management under a CalSavers program without any of the tax benefits associated with setting up an IRS approved qualified retirement plan.

The cost of setting up an IRS qualified retirement plan is greater than a CalSavers plan, however, the administration is not much different. The IRS has provided employers three (3) often overlooked federal tax credits which are available to mitigate these additional costs of establishing an IRS Qualified Retirement Plan that can significantly reduce a company’s taxable income. These are:

- the Retirement Plans Start Up Costs Credit,

- Employer Contribution Tax Credit, and

- the Automatic Enrollment Credit.

Again, the potential income tax benefits of setting up a Qualified Retirement Plan over a CalSavers program can be significant to not only the owners of the business but its employees as well and with the help of these three tax credits the cost of setting up the plan is essentially free.

To help clients, prospects, and others, JLK Rosenberger has provided a summary of the key details below:

Qualified Retirement Plan Start Up Tax Incentives

- Retirement Plan Start Up Costs Credit – This incentive is designed to help companies offset the costs of starting a retirement plan. The maximum benefit is a credit equal to $5,000 per year for 3 years ($15,000 total benefit). It covers qualified start-up costs such as recordkeeping and plan administration fees along with the cost of employee education. The maximum credit amount is determined by the size of the company. For those with 50 employees or less, the credit is 100% of the first $5,000 in annual costs, but for those with 51 to 100 employees, it is limited to a 50% credit against the first $10,000 in annual costs.

To claim the credit a company must have had 100 or less employees that received a minimum of $5,000 in compensation in the prior year. There must be at least one participant who is a non-highly compensated employee. Finally, the three tax years before credit eligibility, employees cannot have been enrolled in another plan sponsored by the company.

- Employer Contribution Tax Credit – Certain small businesses can claim this credit for employer contributions made to a 401k, SEP, or SIMPLE IRA plan over a five-year period. To be eligible, a business must have 100 or fewer employees who received at least $5,000 in compensation in the previous year.

The amount of the credit varies by the number of employees, including 1-50 employees and 51-100. The amount available to those with 1-50 employees includes 100% of contributions, up to $1,000 for years one and two, 75% up to $1,000 in year three, 50% up to $1,000 in year four, and 25% up to $1,000 in year five. Those with more employees receive a similar benefit with a 2% reduction for every employee over 50.

- Auto-Enrollment Tax Credit – For those that offer auto-enrollment, there is a credit of $500 per year for a 3-year period. Note the eligibility period starts the first taxable year the feature is offered. There are three types of automatic enrollment that an employer may select from, including basic automatic enrollment, eligible automatic enrollment arrangement, and the qualified automatic enrollment arrangement. It is important to note that the credit is available to new or even existing plans that offer auto-enrollment.

Total Tax Savings

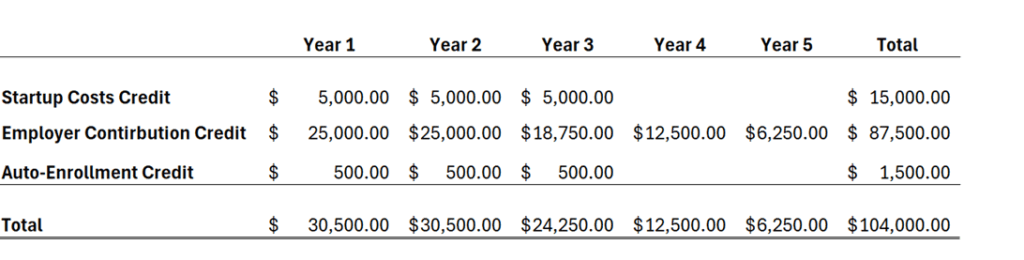

The combination of these incentives can be compelling. For an employer with 25 non-highly compensated employees (NHCE employees), that incurs $5,000 in plan start-up costs, with an employer contribution of $1,000 per employee and auto-enrollment, would receive up to $5,500 per year (or $16,500 over the first three years). Over a five-year period, this would result in a $87,500 tax benefit with a total savings of $104,000. See below for an illustration of the credit savings.

We’re here to help

For many California companies it makes little financial sense to continue in CalSavers when there are significant tax saving options available through a new plan. Since there are very specific eligibility rules, it’s essential to consult with a qualified tax advisor to determine how you can benefit. If you have questions about the information outlined above, or need assistance with another tax or accounting issue, JLK Rosenberger can help. For additional information, call 949-860-9902 or click here to contact us. We look forward to speaking with you soon.