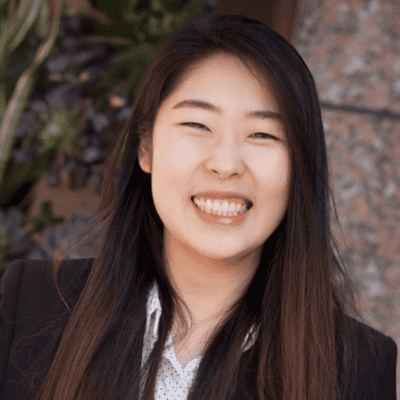

Joyce Zhou, CPA

Manager

Joyce finds satisfaction in tackling her clients' unique challenges as she seeks to learn something new each day.

A client-centric approach allows Joyce to think from the perspective of her clients, ensuring they achieve the most significant tax savings while aligning with their goals. Her clients appreciate her responsiveness as she solves their issues promptly.

Areas of Expertise

Shortly after her internship with the firm ended, Joyce began serving JLK Rosenberger’s construction clients. Her responsibility and dedication have allowed her to specialize in construction tax code. Whether helping clients with consultative tax planning, compliance, R&D studies, or multi-state returns, she’s putting herself in their shoes, using her creativity to do what’s best for them. Joyce has extensive experience with 1031 exchanges, real estate, closely-held business returns, cost segregation studies, and high net-worth individual returns.

Membership & Professional Associations

More About Joyce

Futbal or football

“Basketball. I love the LA Lakers, and I will always love Kobe Bryant.”

Advice for aspiring CPAs

“You have to know what you are looking for and then fight for it to achieve your goals. It’s so fulfilling to take one step at a time and watch those small steps lead to something great!”

Least favorite phrase

“I can’t do it.” This tells me someone is avoiding challenges, staying in their comfort zone, and sticking with things they already know. They aren’t willing to learn.”

What can’t you stop talking about?

“My two cats, Milky and QiQi. They are so cute, and they are my first pets. Before I had them, I didn’t know I could love them like I do. They’ve changed me and turned me into a cat person. I can’t live without them right now.”

Joyce earned a Master of Professional Accountancy from UC Irvine and a Bachelor of Arts in Economics and Administrative Studies from UC Riverside.

Joyce is a “homegrown” employee. She started her journey at JLK Rosenberger as an intern and has worked her way to manager. As a graduate student, she worked at H&R Block as a seasonal tax worker.